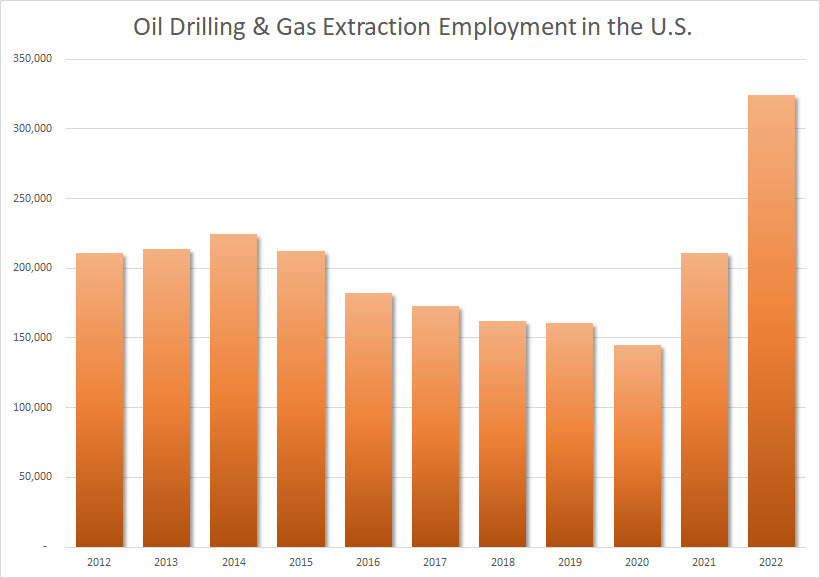

Nearly 325,000 people are employed in the Oil Drilling & Gas Extraction industry in the US as of August 2022 (source). This figure reflects a 54 percent growth in 2022. It is more than double the amount employed before the global pandemic. Yet there is still a labor shortage! See Figure 1 below. Research firms forecast total employment in the overall US Oil and Gas industry will exceed a million in 2027 (source). Yet despite all of this growth, a dire labor shortage still remains in the Oil & Gas industry. What is going on? How can this be the case? Why is there a labor shortage in the Oil & Gas industry? Why is the staffing shortage so much more pronounced and different than in other industries?

Industry Volatility is Only Part of the Story

Virtually every industry was disrupted during the global pandemic. The Oil & Gas industry was no exception. This article, AI Investment by Oil & Gas Industry Set to Explode, explains how there was a “perfect storm” of volatility that erupted over the past couple of years. This helps explain why a radical shift occurred. Two other factors also came into play:

- Industry wages have fallen behind – average hourly wages in the U.S. oil and gas extraction industry are still below pre-pandemic levels. Firms compete for labor against Amazon hiring drivers, or Target with positions in air-conditioned warehouses, compared to working on a drilling rig in Texas in the summer (source).

- The shift to remote working – a lesson learned by both companies and employees during the pandemic is that if given a choice, many workers prefer the option to work remotely. This could come in the form of a hybrid model, working a day or two from home to full-time remote positions. Employment in the Oil Drilling & Gas Extraction industry is very hands-on, so must typically be done in person. This job attribute has changed the profile of the position and is causing a growing number in the field to permanently leave this profession. Not only do employees not want to travel far distances to work in remote locations, but neither do contractors. This is leading the forecast for significant increases in investment in new IT projects to apply intelligent process automation to the industry to help streamline and automate operations.

A Compelling Case to Automate

IDC Research recently published a FutureScape report with Worldwide Oil and Gas 2023 Predictions. The report suggests a substantial investment will occur in automation technologies.

IDC Prediction: By 2027, 40% of Onshore Exploration and Production Companies Will Bridge Field Labor Shortages with Automation Through Robotics, Edge Computing, and Connectivity (source).

It appears that a growing consensus now exists in the Oil & Gas industry that the labor shortage is systemic. New options must be considered to address the current and future expected staffing shortage. Adding further complexity, most new workers don’t have industry experience, so are more prone to safety incidents.

Despite the advances made to reduce unnecessary site visits by supervisors or contractors, there is still a heavy reliance upon in-person labor to run drilling equipment or complete a well. This is especially the case with unconventional drilling developments or locations.

As a result of this increased investment in automation technologies to address the labor shortage in the oil & Gas industry, additional IT investments are needed. This investment is needed to improve collaboration between systems and third-party contractors. Increased security risks must also be addressed. These system upgrades must be done securely as digital and field operations converge.

It is highly likely new solutions will be needed to drive innovation in how field operations are managed and performed. This next wave of digital transformation investment must be coordinated with enterprise IT systems and IT departments. This will cause additional complexity and communications requirements not experienced by this industry before.

A Convergence of IT and OT Systems Cultures

As companies embrace automation to address the labor shortage in the Oil & Gas Industry, a culture shift will also be needed. Crews working in the field in remote areas have traditionally operated autonomously. Decisions are often made as needed, based on what is observed and learned onsite. In the transition to digital strategies with the automation of processes, decisions will need to be made with greater collaboration. Here is where the growing importance of data collection will emerge to the forefront of making some decisions that were previously based on the experience and knowledge of industry veterans.

Those responsible for leading these new digital and automation strategies should consider the experience of potential new partners. Third-party solution providers should have knowledge of not only the technologies and systems integration required but also how to merge the data spanning Information Technology (IT) and Operations Technology (OT) systems used in the field. This integration is far beyond the systems, but also includes the staff associated with each discipline. Each has its own culture, but now must learn how to work together – a task often easier said than done!