The Federal Reserve’s ability to perfectly execute a “soft landing” is increasingly becoming less likely. Too many big swings of too many variables have occurred over the past several months. The global economy suffered many shocks – each with a ripple-through effect that is exasperating other macroeconomic trends. Planning for the worst and hoping for the best now seems the best option. With a low volume Real Estate market now emerging, what is the best strategy for companies to weather the storm?

An Assessment of Today’s Real Estate Market

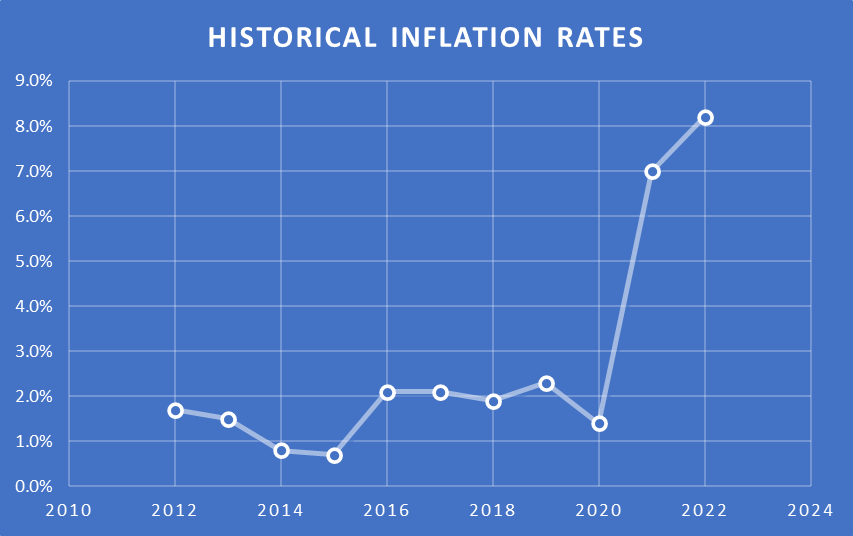

The first headwind to today’s market slowdown was inflation quickly increasing to historic levels. As of October 2022, the rate is 8.2 percent. This increase was significant, as shown in the below chart showing annual inflation rates over the past 10 years (source).

With this surge has come an equally strong increase in mortgage rates, now averaging over 7 percent for a 30-year fixed mortgage (source). That is a 20-year high! This rate increase translates into a new mortgage payment that has grown by 69 percent through the first nine months of 2022 in America’s 50 largest regional housing markets (source). At the same time, housing prices have become increasingly unaffordable over the past two years – increasing on average by 35-40 percent, according to the Case-Shiller index (source).

The combined impact of these market shifts has resulted in a low volume Real Estate market. New homebuyers can no longer qualify, existing homeowners can’t afford the new payment to move up, and no one is refinancing given the recent rate run-up. Add to this the uncertainty of a recession in 2023, and you have the makings for a rapid contraction of the Real Estate, lending, and title insurance industries.

What is the Best Business Strategy Today?

As a first step, every business should now be conserving cash flow and minimizing operating expenses. Future investment should be limited to improving productivity and increasing operational agility. While today’s current conditions are ominous, there is an essential difference between today’s conditions and those typical of entering the larger-scale downturn of recessions in the past. People are employed.

The unemployment rate for the U.S. is now at 3.5 percent – a healthy, strong, and near full employment level. With people working, goods and services will continue to be purchased and the overall economy will keep going. Most people understand we are now in a “Covid hangover” whereby the rapid shifts in spending over the past two years were primarily due to sudden changes during the global pandemic.

These shifts occurred at a level not seen in many generations. As a result, they occurred at breathtaking speed. Similarly, the Federal Reserve’s actions will eventually bring down rates quickly prompting the financial markets to stabilize. New spending patterns will emerge. This change could occur quickly, opening up new opportunities faster than we have ever seen in the past.

Management teams at companies that understand the source of all the turbulence today know that improving agility and resilience are two of the best business strategies today. But what does it mean to be “agile” or “resilient?”

How to Be an Agile Business

Agility means being able to adapt to changes quickly. Resilient businesses can adjust quickly to external environmental changes – and can do so with minimal interruption. We saw this at the start of the pandemic with the restaurant industry. Some eateries just closed their doors. The thought was they could just wait out the shelter-in-place programs that were put in place. Others adapted by converting their business model into one where patrons placed orders to go. As new Covid restrictions were put in place, the agile businesses adapted faster and were able to minimize the impact on their staffing, customer satisfaction, and overall business profitability.

Those in the Real Estate, Financial Services, or Title industry must now adjust similarly. Investment in Intelligent Process Automation is a great example. These types of IT investments will improve how quickly a business can respond when shifting from a high to a low and then back up to a high-volume business. Removing manual or paper-based processes adds new levels of resilience and agility across an entire business.

Consider New Partnerships

This might be a great option to consider given the increase in volatility and transaction volume expected over the next 12-18 months. Aligning with a partner to spread costs and risk can help reduce an impact on profitability. Similarly, working with a managed services partner is another way to improve how your business operations can more effectively and quickly expand or contract with less impact on your bottom line. Shifting costs to be more variable will better align costs with revenue.

Those evaluating this option should consider that many factors are part of the decision process when bringing on a new business partner. This article, 6 Attributes to Look For When Choosing a Business Partner, suggests an assessment of complementary skills and interests, excitement and passion about your business, and a level of mutual trust that you can each work together for a common goal.

If you are a Title industry professional and are considering what managed services might be suitable for outsourcing. Document management and data extraction are good places to start. Read this case study, A Business Case for Smart Data Extraction, to gain a better understanding of what benefits are possible.

One thing that is certain today is that it is impossible to predict what the next few months will bring. No one had the vision we would now see mortgage rates be at 7 percent today, contributing to a low volume Real Estate market. Similarly, no one really can know what the future will hold in 2023. But investing in agile systems and business strategies can provide you with the ability to respond faster to change. This will then put you in the best position to take advantage of the next business opportunity – and do so faster than your competition.