Traditional Banks, Financial Services, and Title companies have often struggled to maintain meaningful relationships with their customers. Historically, these institutions have operated within a framework that prioritized efficiency over personalization, often resulting in customer disconnects. Generative or Gen AI now has the potential to disrupt this trend – which would be a good thing. Gen AI in Financial Services is a great example of how vast amounts of data, transactions, and activity can be analyzed and understood more efficiently. In the end, customers might end up the winner.

Dating back to the industrial age, banks have relied on standardized processes and rigid hierarchies to manage customer relationships. While this approach served its purpose in an era characterized by limited data and face-to-face interactions, it has become increasingly inadequate in today’s digital age.

Examples of these disconnects are abundant.

- Inefficient data practices mean that banks often possess vast repositories of customer information but cannot extract actionable insights. This leads to missed opportunities to better understand individual customers’ needs and preferences.

- Impersonal interactions have long been a hallmark of traditional banking. From generic marketing campaigns to ATMs to online banking to scripted customer service interactions. Banks continue to struggle to convey a sense of understanding and empathy to their clientele.

- Siloed services and departments further exacerbate these issues. Fragmented departments and legacy systems often result in disjointed customer journeys, where clients face repetitive inquiries and inconsistent service across channels. This not only frustrates customers but also undermines the bank’s ability to deliver seamless experiences.

These shortcomings have far-reaching consequences. Dissatisfied customers are more likely to switch banks, eroding loyalty and diminishing long-term profitability. Moreover, in an era where customer experience reigns supreme, banks that fail to address these disconnects risk falling behind more agile and customer-centric competitors.

Accelerating The Move to Customer Centricity

Part of the challenge that has held back traditional financial service firms is the primary focus on security. This philosophy extends to how transactions, systems, and processes are designed to help ensure the highest level of security. Consequently, change is slow. New technology adoption is carefully considered and evaluated.

Here are a few examples of common business challenges faced by most businesses. What is interesting is that other industries have done better in overcoming them. Now might be an opportunity for Gen AI in Financial Services to finally help overcome these issues.

- Delivering an end-to-end customer experience

- Resolving customer support issues during the first call or engagement

- Promoting relevant, competitive offers to the right existing customers

- Effectively managing business risk without impacting the customer experience

- Managing regulatory requirements without stifling innovation

- Streamlining the delivery of new product offerings to the right target persona, at the right time in their customer lifecycle

These challenges not only impede customer satisfaction but also jeopardize banks’ profitability by driving churn and impeding cross-selling opportunities.

In this context, the transformative potential of Gen AI-powered personalization becomes evident. By harnessing the power of artificial intelligence, banks can bridge the gap between customer expectations and traditional banking practices, ushering in a new era of customer-centricity and growth. In this context, AI can be a transformative force reshaping the financial landscape. By harnessing AI and predictive analytics, banks can unlock actionable insights from vast data repositories, enabling hyper-personalized customer interactions.

The Market Potential for AI in Financial Services

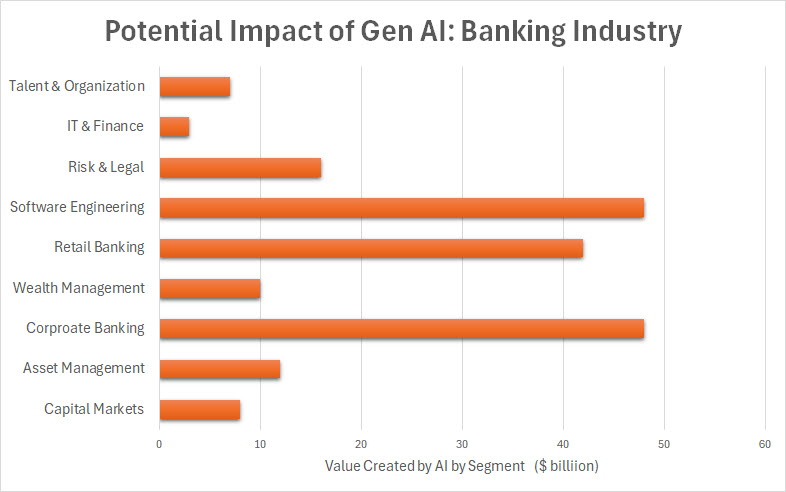

The McKinsey Global Institute (MGI) published research findings on the future impact of Gen AI. The study estimates that Gen AI could add between $200 and $340 billion of annual revenue to the banking industry. This translates into 2.8 to 4.7 percent of total industry revenues, largely through increased productivity (source). See the below table.

While the opportunity for efficiency and profitability is significant, so are the risks. These include the generation of false or illogical information, intellectual property infringement, limited transparency in how the systems function, issues of bias and fairness, security concerns, and more.

The Benefits of Working with a Partner

One of the reasons why it makes sense to work with a subject matter expert is to reduce business risk. By partnering with IT systems integrators familiar with Gen AI, banks can more readily and seamlessly implement new solutions. These can then lead to enriched customer engagement and satisfaction. Systems integrators play a pivotal role in bridging legacy systems with cutting-edge AI technologies, ensuring smooth transitions and minimal disruptions.

To achieve a successful deployment of a next-generation AI solution, a shift in perspective is imperative. This entails prioritizing end-user experience, necessitating a reevaluation of processes. AI agents must be user-centric, and capable of adapting through reinforcement learning from human feedback, ensuring alignment with human input.

Additionally, comprehensive change management is vital for successful gen AI scale-up. This includes user-centered change management, training for leadership and employees, and role modeling by leaders and influencers. It articulates clear priorities, investments, and outcomes. It helps establish a new mindset while ushering in a cultural shift that can provide explicit and implicit incentives. Transparency and pragmatism are paramount throughout the change management process.

Read more about picking the right partner to implement AI projects, Navigating the Spectrum of AI & Picking the Right Partner.

The Future of Gen AI in Financial Services

AI-driven personalization has the potential to bring in a new era of customer-centricity in the financial services sector. By embracing this shift and partnering with innovative IT integrators, financial services organizations can unlock unprecedented opportunities for growth and differentiation, securing their position in an increasingly competitive market.