One lesson learned over the past couple of years is that predicting the future has never been harder! Change has been swift, substantial, and unexpected. This type of thinking applies to what we think, where we live, and how we work. The Real Estate market has been turned upside down. The market got used to very low-interest rates – even negative rates in some countries. The Real Estate industry has experienced other challenges in the past and has survived. This too shall pass. A new equilibrium appears to already be emerging. The Real Estate lending industry could soon stabilize and be positioned for growth in 2023. Will you be ready?

What Should We Expect in 2023?

No one know can know exactly what will happen in the Real Estate lending industry over the next few months. But we can look at several economic indicators to better assess what is likely to occur.

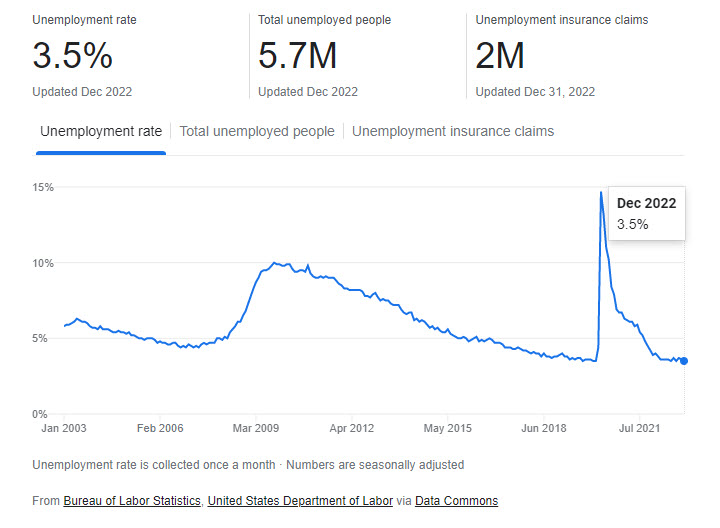

To start, a very important factor is that the employment rate is currently at 3.5 percent. This is a record low. The last major recession to hit during the 2007-2009 global financial crisis resulted in a doubling of the unemployment rate from 5 to 10 percent. That market downturn resulted from greed, underwriting issues, and systemic fraud that had been building over many years.

Today’s increase is a “boomerang” repercussion from governments all over the world battling a global pandemic. Government stimulus checks artificially inflated the money supply and demand for goods. People had time and money – so they started buying a lot of stuff. These purchases included new homes and the remodeling of existing homes, given that interest rates were so low. Then, as travel restrictions eased, many went on vacations, traveled, and ate out at restaurants. This surge in purchases contributed to a leap in inflation over the summer. Today we are suffering from a “hangover” as a result of these actions, which appears to now be easing.

Based on this assessment, here are five reasons why 2023 could be a very strong year for the Real Estate lending industry:

1. The economy is proving to be quite resilient

The underlying fundamentals of the U.S. economy are strong. The speed that the unemployment rate went up and came back down is quite remarkable and an indicator of how quickly the economy can rebound. See the chart below.

Learn more about the importance of resilience in today’s economy, Improving Resilience in the Real Estate and Title Industries.

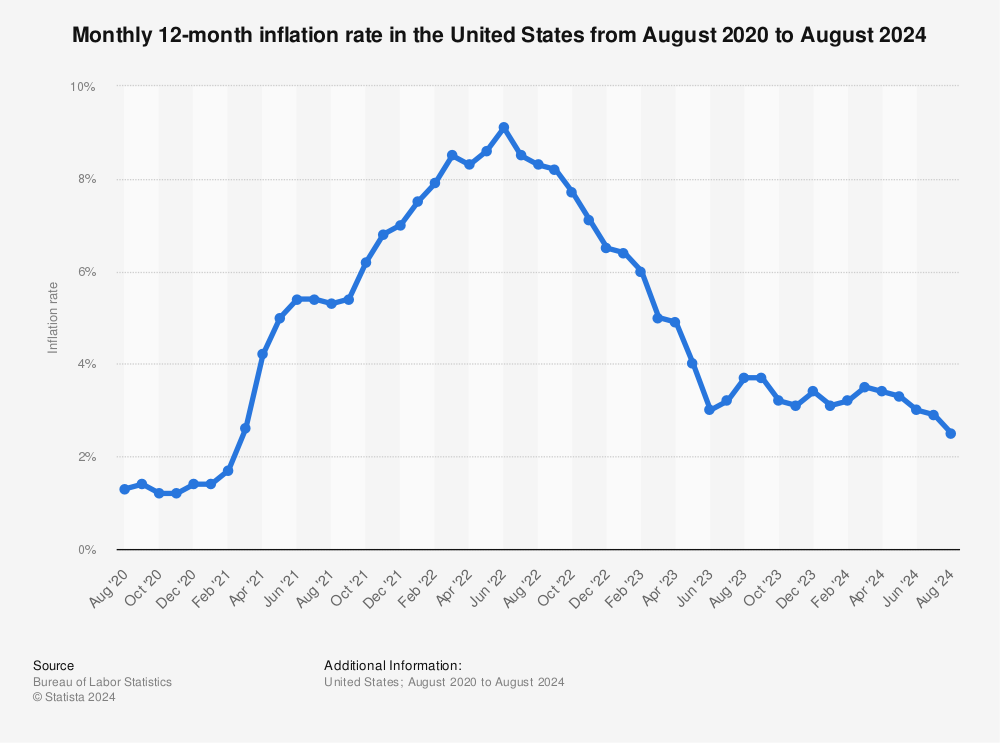

2. The rate of inflation is declining

According to data published by Statista Research, the monthly (annualized) inflation rate in the U.S. has declined every month since June 2022. This trend suggests that the actions taken by the Federal Reserve Bank are having an impact. In addition, the rate of spending by U.S. households might have begun to decline. Lower spending creates less competition to purchase goods and lowers prices. If the inflation rate continues this rate of decline, then we could be down to a more manageable rate as soon as the summer. This would obviously be a benefit for the Real Estate lending industry. Investors appear to also be seeing this positive pattern given the recent moves in the markets.

Find more statistics at Statista.

3. The housing market is healthy

The Mortgage Bankers Association just announced its U.S. 2023 forecast and is expecting this year to be one of the best mortgage years in the last 20 years! While it won’t match 2020 or 2021, purchase mortgage dollar volume should be better than any year from 2002–2019 (source). View the complete MBA forecast and report here. Prices did increase at an inflated rate over the past couple of years, but there are signs that softening is already happening based on interest rates going up. Note that today’s lending environment will be different than it has been over the past few years. Refinanced lending activity has dropped precipitously. Total volume, however, is expected to be about $1.9B for 2023 – a health volume for the industry.

4. People still want to own a home

There is not a drop in demand for housing. Today, it is an affordability issue that is creating problems. The overall population in the U.S. continues to grow. Remote working options have expanded the geographies of where people can now live. This shift has expanded the number of markets where Real Estate purchases are now viable. Given that substantial demand exists, soon the supply should start to grow as builders see opportunities to develop new communities.

5. The industry has become more efficient

COVID forced many changes in the Real Estate lending industry. In-person activities have been replaced with virtual, online processes. Loans are processed with greater efficiency. Artificial Intelligence and machine learning have greatly improved how data can be extracted and processed – such as during the Title search and review process. The industry has invested heavily in new automation processes that have added greater flexibility and resilience to back-office operations. What has resulted is a drop in costs and higher profitability to better weather future storms of disruption.

So, what do all of these observations mean? To start, things may not be quite as bad as originally thought just a few months ago. There is a possible scenario whereby the Fed pulls off a “soft landing” and steers the economy to another period of gradual, sustained growth. Organizations that invested in streamlining operations and systems respond faster to change. These companies will be best positioned for the next growth opportunity.

Alternatively, firms that have not recently invested in intelligent process automation, RPA, or other process improvement programs would be well advised to start now. One thing that is certain is that the future will change. Eventually, the markets will come back strong and provide great opportunities for new business growth once again.